In recent times, the concept of Gold IRA rollovers has gained important traction amongst buyers seeking to diversify their retirement portfolios. This observational research article aims to discover the method, benefits, and challenges associated with Gold IRA rollovers, shedding mild on the motivations behind this investment strategy and its implications for monetary safety in retirement.

The Idea of Gold IRA Rollovers

A Gold IRA rollover refers to the strategy of transferring funds from a traditional Individual Retirement Account (IRA) or a 401(okay) right into a self-directed IRA that holds bodily gold or other precious metals. This funding strategy allows people to diversify their retirement financial savings by together with a tangible asset that traditionally retains value, particularly during economic downturns.

Motivations Behind Gold IRA Rollovers

- Hedge Against Inflation: Certainly one of the primary motivations for investors to consider Gold IRA rollovers is the need to protect their retirement savings from inflation. Gold has an extended-standing fame as a protected haven asset, often appreciating in value when fiat currencies depreciate. Observational data suggests that buyers are increasingly concerned about the potential for inflation to erode their buying power, prompting them to seek different investments.

- Market Volatility: The unpredictability of monetary markets can result in anxiety amongst buyers. Many people flip to Gold IRA rollovers as a technique to mitigate dangers related to inventory market fluctuations. By incorporating gold into their portfolios, traders aim to achieve higher stability and safeguard their belongings against market downturns.

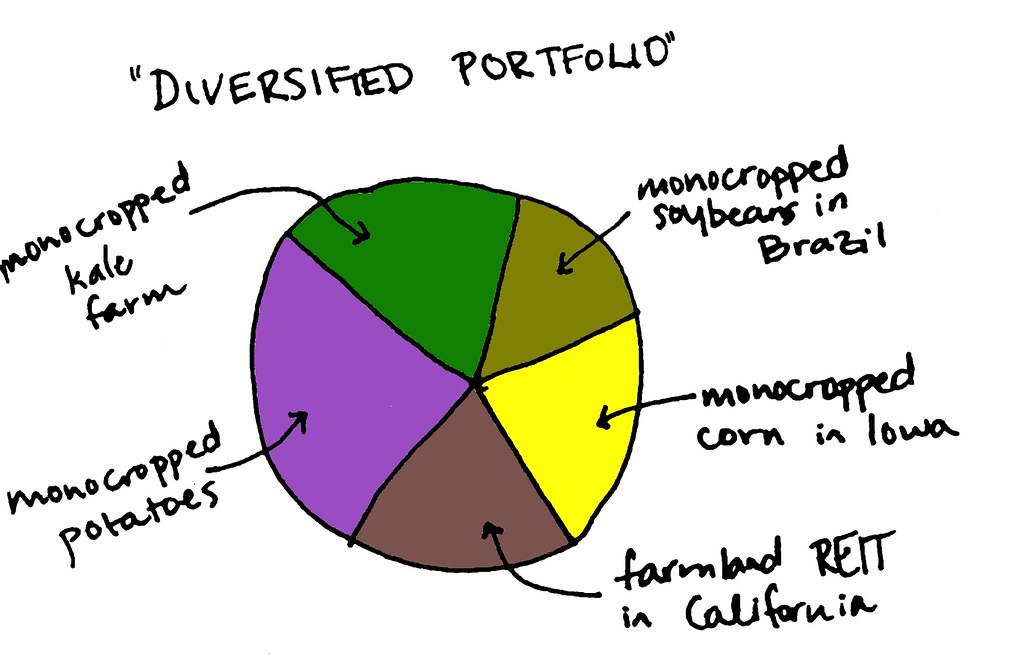

- Diversification: Monetary advisors typically emphasize the importance of diversification in investment portfolios. Gold serves as a non-correlated asset, which means its price movements are indirectly tied to the efficiency of stocks and bonds. This characteristic makes gold a gorgeous option for those trying to stability their portfolios and reduce total risk.

The Rollover Course of

The strategy of executing a Gold IRA rollover includes a number of key steps:

- Selecting a Custodian: Buyers should choose a qualified custodian that specializes in self-directed IRAs and is authorized to carry bodily treasured metals. The custodian performs a crucial function in managing the account and making certain compliance with IRS laws.

- Opening a Self-Directed IRA: As soon as a custodian is chosen, buyers can open a self-directed IRA. This type of account allows for better flexibility in investment choices, together with the power to carry bodily gold.

- Initiating the Rollover: Buyers should contact their present IRA or 401(ok) provider to initiate the rollover process. This usually includes finishing paperwork and providing information about the brand new self-directed IRA.

- Purchasing Gold: After the funds are efficiently transferred to the new IRA, traders can buy bodily gold or different accredited valuable metals. It is essential to make sure that the metals meet IRS requirements for purity and type.

- Storage: The bodily gold should be stored in an IRS-approved depository. Traders can not take possession of the gold themselves, as this would violate IRS rules governing retirement accounts.

Advantages of Gold IRA Rollovers

- Asset Protection: Gold is usually seen as a safeguard against economic uncertainty. Its intrinsic worth and historical performance make it an interesting choice for traders wanting to guard their wealth.

- Tax Advantages: Gold IRAs supply tax-deferred growth, that means that buyers don’t pay taxes on features until they withdraw funds throughout retirement. This may lead to vital tax savings over time.

- Liquidity: Gold is a globally acknowledged asset that can be easily purchased and sold. This liquidity can provide traders with fast access to cash if needed.

- Long-Term Growth Potential: While previous efficiency is not indicative of future results, gold has traditionally appreciated in value over the long term. This potential for development attracts traders seeking to construct wealth for retirement.

Challenges and Concerns

Despite the advantages, Gold IRA rollovers are not without challenges:

- Market Dangers: While gold is commonly thought of a safe haven, its value might be volatile. Buyers should be prepared for fluctuations in value, which can not at all times align with their expectations.

- Charges and Prices: Buyers should remember of the varied fees associated with Gold IRAs, including custodian charges, storage fees, and transaction prices. These bills can impression overall returns and must be carefully thought-about.

- Regulatory Compliance: The IRS has strict rules governing the kinds of valuable metals that may be held in an IRA. If you have any queries regarding exactly where and how to use gold ira investment provider reviews, you can get in touch with us at our own web page. Traders should ensure that they comply with these rules to keep away from penalties and tax liabilities.

- Lack of Revenue Era: In contrast to stocks or bonds, gold does not generate earnings in the type of dividends or curiosity. Traders counting on common revenue during retirement might have to consider this side when planning their portfolios.

Conclusion

Gold IRA rollovers current a compelling possibility for buyers looking for to diversify their retirement portfolios and protect their wealth from financial uncertainties. As observed by means of numerous motivations, the want for inflation protection, market stability, and diversification drives people to explore this investment technique. However, potential challenges, including market risks, charges, and regulatory compliance, must also be taken under consideration.

As the monetary landscape continues to evolve, the position of precious metals in retirement planning will doubtless remain a topic of interest for traders. By understanding the intricacies of Gold IRA rollovers, individuals could make knowledgeable decisions that align with their long-term monetary objectives and aspirations for a safe retirement.